by Bill McBride on 7/12/2013 08:47:00 AM

A few excerpts from the JPMorgan investor presentation (Q2 results):

Mortgage Production pretax income of $582mm, down $349mm YoY, reflecting lower margins and higher expense, partially offset by higher volumes and lower repurchase lossesMortgage originations of $49.0B, up 12% YoY and down 7% QoQ

Purchase originations of $17.4B, up 50% YoY and 44% QoQ

...

If charge-offs and delinquencies continue to trend down, there will be continued reserve reductionsRealized repurchase losses may be offset by reserve reductions based on current trends

If primary mortgage rates remain at or above current levels, refinance volumes and margins will be under pressure and Mortgage Production profitability will be challenged

emphasis added

Click on graph for larger image.

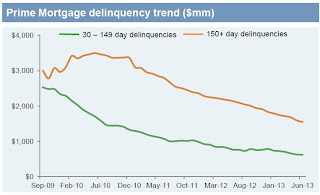

Click on graph for larger image. This graph is from the JPMorgan presentation this morning. The good news is mortgage delinquencies are trending down, and purchases originations are up sharply year-over-year.

However the refinance volumes and margins will probably fall off a cliff in Q3.

Source: http://www.calculatedriskblog.com/2013/07/jpmorgan-at-or-above-current-mortgage.html

Super Moon 2013 miami heat Kim Kardashian Baby Lil Snupe Paula Dean Racial Slur Vine Summer solstice 2013

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.